When UnitedHealthcare CEO Brian Thompson was gunned down on a Manhattan sidewalk Wednesday morning, he suddenly became symbol of the much-despised health insurance industry. The shooter appeared to have social motivations. Bullet casings left at the scene had been inscribed with the words “deny,” “defend” and “depose” — terms associated with insurance companies’ tactics to reject customers’ claims. The apparent backpack of the shooter found in Central Park contained Monopoly money.

Thompson’s death has inspired a torrent of fury about the way his insurance company and others mistreat people in their moments of greatest need. People have been flooding social media posts with statements chastising UHC for its policies, bringing up times they were personally denied coverage or hit with huge bills for services. People spoke up about being denied coverage for a congenital defect or infant care.

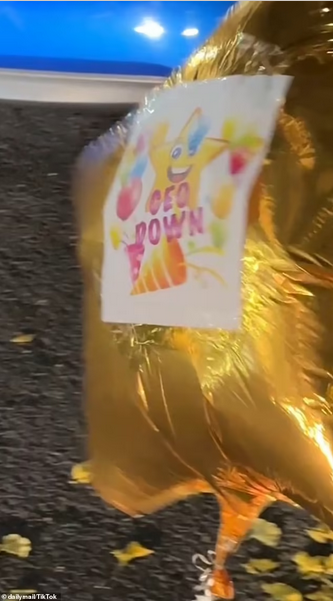

Many people are celebrating Thompson’s death, in posts and memes seen by millions. In posts that trended on multiple social media platforms, users mocked Thompson’s death by invoking health insurance terms, saying their empathy for his loss had been “denied,” or that being a CEO of a Health Insurance Company was a “pre-existing condition.” Other users implied the killing was merited, citing UnitedHealthcare’s frequent rejections of customers’ requests. Many of the posts were liked by tens of thousands of users, some of whom chimed in with their own stories of struggling to get the corporate giant to cover their health insurance claims. When UnitedHealth Group posted the news of Thompson’s death to Facebook on Wednesday, the vast majority of reactions, more than 76,000 and counting, were the laugh-crying emoji. On Thursday, a celebratory balloon was left at the scene of the shooting (pictured).

The reaction speaks to an underlying populist frustration and rage. Those lucky enough to have health coverage in the US have gone through some nightmare experience with their health insurance provider.

According to a survey conducted last year by KFF, a nonprofit health-care think tank, about 6 in 10 adults reported experiencing problems with their health insurance during the previous 12 months, such as being hit with surprise bills or being turned away from services. And as people got sicker, their problems got worse; more than one-third of people who said they were in fair or poor health said their health insurer did not cover a prescription drug or required a very high co-pay for a drug that a doctor prescribed. KFF’s surveys have persistently identified adults who describe being compelled to make trade-offs to pay for health care, such as being unable to afford their rent or mortgage.

Patient advocacy groups have documented how the companies use tactics such as “prior authorization,” requiring physicians to submit additional paperwork to justify their treatments and prescriptions. News organizations have detailed how UnitedHealthcare has relied on algorithms to swiftly deny care.

According to an investigation by the medical news site Stat and a federal lawsuit recently filed in Minnesota, UnitedHealthcare has been using a deeply flawed artificial intelligence algorithm to wrongfully deny healthcare to elderly and disabled patients. Stat reported that the company “pressured its medical staff to cut off payments for seriously ill patients … denying rehabilitation care for older and disabled Americans as profits soared.”

Personl stories of terrible interactions with the largest health insurer in the country also poured forth.

Elizabeth Austin, a single mother who lives in Pennsylvania, reported that she had a miserable experience with UnitedHealthcare after her young daughter, Carolyn, was diagnosed with leukemia during the COVID-19 pandemic. Her chemotherapy caused nausea, so Carolyn’s doctor ordered a nighttime feeding tube to supplement what little she was able to eat while awake. She said United Healthcare wouldn’t pay for the feeding tube unless Carolyn ate no solid food at all.

Later, when Carolyn developed a sensitivity to a sedative used during her monthly lumbar punctures, her doctors switched to another medicine, and the company again denied payment, Austin said. She paid for that herself too.

Austin said she eventually developed a stress-related heart condition that required ablation surgery. She and her daughter are healthy now, but the scars remain.

As people forego life-saving care for themselves or their loved ones, or face losing their home in order to save their lives, insurers are making massive profits off of their misery. The early morning assassination of one health insurance CEO has awakened the need to resist this injustice.